That’s according to the Cosmo (Covid Social Mobility and Opportunities) study

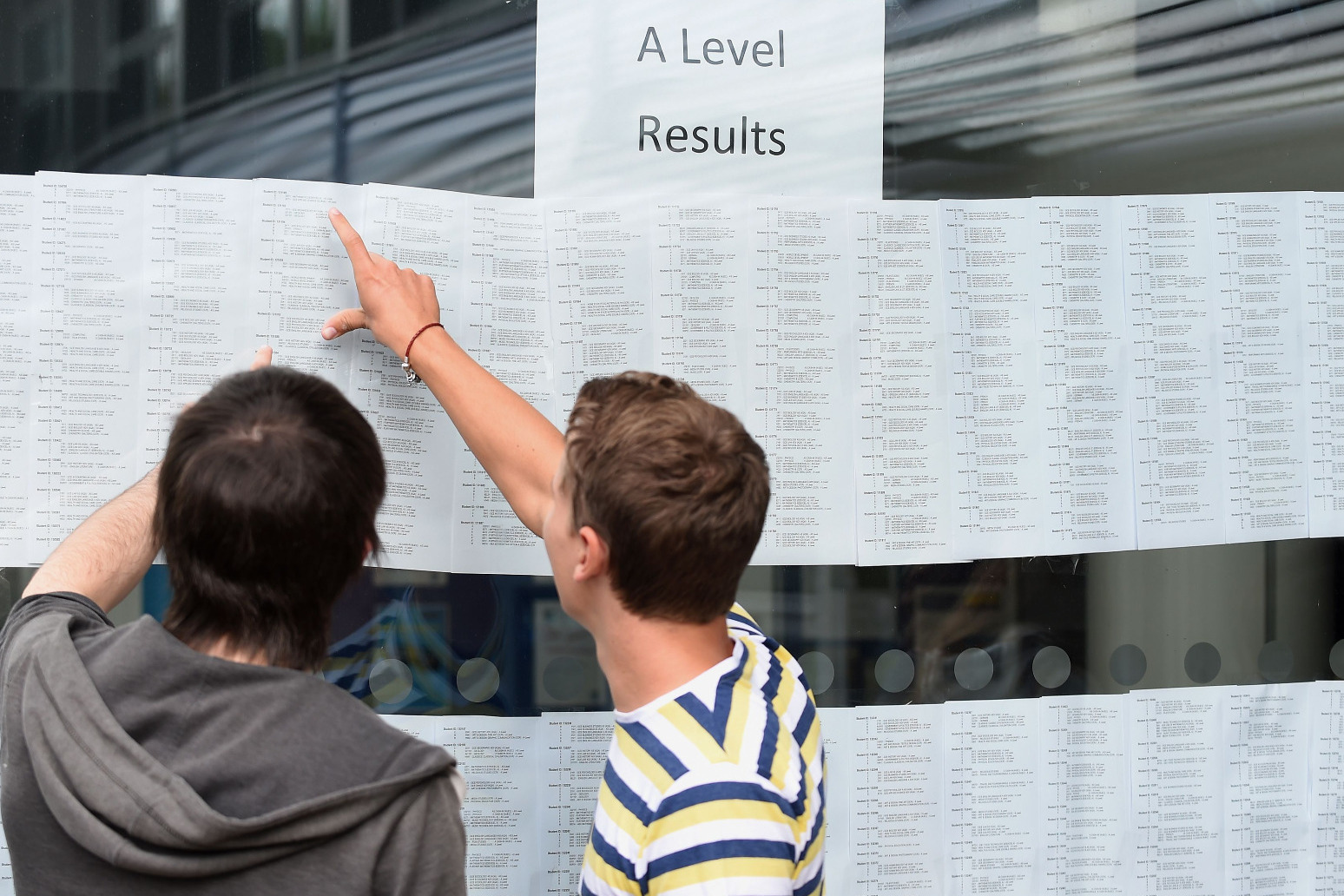

One in five students awaiting A-level results plans to live at home while studying at university, prompting concerns that cost pressures are limiting young people’s educational choices.

Students from disadvantaged backgrounds are more likely to plan to study locally than their peers – and “cost concerns” may be a driver of the decision for a number of young people, a report suggests.

A fifth (20%) of Year 13 students who have either applied or plan to apply to university said they would live at home during term time if they got into their preferred university, while 14% said they had not yet decided, according to the Cosmo (Covid Social Mobility and Opportunities) study.

The study has been tracking the lives of a cohort of thousands of young people in England who took A-level exams and equivalent qualifications this summer. In total, 11,523 students in Year 13 were surveyed between October 2022 and April 2023 as part of the research.

Among those who plan to live at home, only 19% said the main reason was because their preferred university was near their home, according to the study by the UCL Centre for Education Policy and Equalising Opportunities, the UCL Centre for Longitudinal Studies, and the Sutton Trust.

Nearly a fifth (18%) said the main reason was because they could not afford to live away from home, while 46% said they wanted to be near their families.

“Our concern is cases where cost or related factors are driving this decision, which is likely to entrench existing inequalities between those from different socioeconomic groups,” the report says.

The study suggests that young people who plan to live at home are disproportionately more likely to be those from families facing financial challenges amid the rising cost of living.

Among those who said they had applied or plan to apply to university, young people from families which reported using a food bank in the past year were more likely to plan on living at home while studying compared to those families which did not use a food bank (31% v 19%).

Young people planning to live at home are also less likely to express a preference to study at an elite Russell Group university as those planning to move away (37% v 56%), the analysis suggests.

The report adds: “While choosing to attend a local university and to live at home while studying helps to reduce the upfront costs of participating in HE [higher education], it could also limit university choices. This is most likely for those from disadvantaged backgrounds.

“Furthermore, given their uneven geographical spread, this could particularly affect the likelihood of those from less advantaged backgrounds applying to more prestigious universities.”

The research also suggests that young people with various measures of disadvantage were much less likely to either have applied to or plan to apply to university compared to their better-off peers.

Those from working class families were less likely to have applied, or were planning to apply, to university compared to those with parents in managerial or professional occupations (57% v 77%).

Researchers have called on the Government to reintroduce maintenance grants for disadvantaged young people who want to study at university.

They added that “improved financial support” for students’ living costs is needed due to the rising cost of living.

Jake Anders, associate professor and deputy director of the UCL Centre for Education Policy and Equalising Opportunities, said: “It is concerning that young people, more likely to be from less well-off backgrounds, are curbing their educational choices because of worries about the cost.

“For some planning on going to university, living at home will be the right choice for them, for a whole host of reasons. But it should be exactly that — a choice — not something they feel they must do because of the financial challenges of living away from home during term time.

“Student support has not kept up with the rising cost of living, this should be urgently addressed so we do not close down opportunities, especially to those who are already likely to have fewer.”

Sir Peter Lampl, founder and chairman of the Sutton Trust, said: “These research findings highlight the difficult decisions many young people face as they weigh up their future.

“Young people from disadvantaged families are less likely to apply to university and are less likely to live away from home if they do apply, limiting their university choice.”

Geoff Barton, general secretary of the Association of School and College Leaders (ASCL), said it was “disappointing” that family background continues to play a huge role in the opportunities available to young people.

He said: “There are many reasons why students may decide to live at home but clearly living costs are becoming an increasingly big factor and causing some people to not even apply for university in the first place.”

A Universities UK (UUK) spokeswoman said: “No student should have to make a decision about their future due to financial pressures – including whether to study away from home.

“While the entry rate gap between the least and most advantaged students narrowed to a record low last year, universities are aware that there is a long way still to go.

“University is an excellent investment, and we urge the government to reintroduce maintenance grants and ensure student support keeps pace with inflation so that less advantaged students are free to choose the route which is best for them.”

A Department for Education spokeswoman said: “Our student finance system ensures that the highest levels of support are targeted at students from the lowest income families. This means support goes where it is needed most while ensuring the student finance system remains financially sustainable.

“We are also supporting universities to help students who are struggling financially by making £276 million available from this month, which institutions can use to top up their own hardship schemes. This is on top of increases to student loans and grants.”

Published: by Radio NewsHub